Decision Making with Uncertainty#

Michael J. Pyrcz, Professor, The University of Texas at Austin

Twitter | GitHub | Website | GoogleScholar | Book | YouTube | Applied Geostats in Python e-book | LinkedIn

Chapter of e-book “Applied Geostatistics in Python: a Hands-on Guide with GeostatsPy”.

Cite this e-Book as:

Pyrcz, M.J., 2024, Applied Geostatistics in Python: a Hands-on Guide with GeostatsPy [e-book]. Zenodo. doi:10.5281/zenodo.15169133

The workflows in this book and more are available here:

Cite the GeostatsPyDemos GitHub Repository as:

Pyrcz, M.J., 2024, GeostatsPyDemos: GeostatsPy Python Package for Spatial Data Analytics and Geostatistics Demonstration Workflows Repository (0.0.1) [Software]. Zenodo. doi:10.5281/zenodo.12667036. GitHub Repository: GeostatsGuy/GeostatsPyDemos

By Michael J. Pyrcz

© Copyright 2024.

This chapter is a summary of Decision Making with Uncertainty including essential concepts:

establishing model realizations and decision scenarios

calculating expected profit over decision scenarios and selecting decision scenario that maximizes expected profit

designing loss functions

calculating the estimate that minimize the expected loss

YouTube Lecture: check out my lectures on:

For convenience here’s a summary of the salient points.

Motivation for Decision Making with Uncertainty#

We have built uncertainty models, now we need to make decisions in the presence of uncertainty.

Building Uncertainty Models#

How did we calculate our uncertainty model(s)? Some examples,

Bayesian Updating - prior plus likelihood to calculate the posterior, for example, probability that a coin is fair, uncertainty in reservoir OIP

Bootstrap + Monte Carlo Simulation and Transfer Function - uncertainty the mean porosity by bootstrap, then Monte Carlo simulation for uncertainty in oil-in-place

Kriging - kriging estimate and variance with Gaussian assumption for uncertainty in mineral grade at a location

Simulation and Transfer Function - reservoir features realizations applied to flow simulation to calculate pre-drill production uncertainty at a new well

One way or another, we have calculated a reasonable uncertainty model, for example,

connected volume of water or hydrocarbon to a location

mineral or hydrocarbon resource in place

recover factor mineral or hydrocarbon extraction

and now we must make a decision with that uncertainty model, for example,

number and locations of wells

time and volume injected for water of chemical flood, pump and treat remediation

dig limits and mine plan

Aspects of Subsurface Decision Making#

Decision making for subsurface development is a massive, integrated challenge! For an example consider the various aspects related to well site selection,

Integer programing problem, output must be an integer or discrete choice and not continuous

Optimization including single choice and joint choice optimization with constraints between each choice

Experimental design to explore a potentially vast uncertainty model space and then statistical / machine learning models to develop response surface, surrrogate models to support larger Monte Carlo simulation studies

Let’s back up and consider the problem from a data science perspect, our well site selection problem includes,

High dimensionality - complicated by large number of geological and engineering parameters in space and time

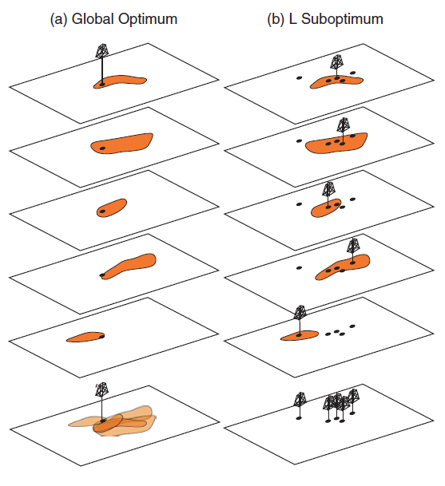

Interactions - complicated constraints and feedbacks between the geological and engineeirng parameters and our decisions, i.e., it is not appropriate to make \(L\)-optimum choices, a set of choices that are optimum for each model, instead we must make one globally optimum choice.

Expected Profit Workflow#

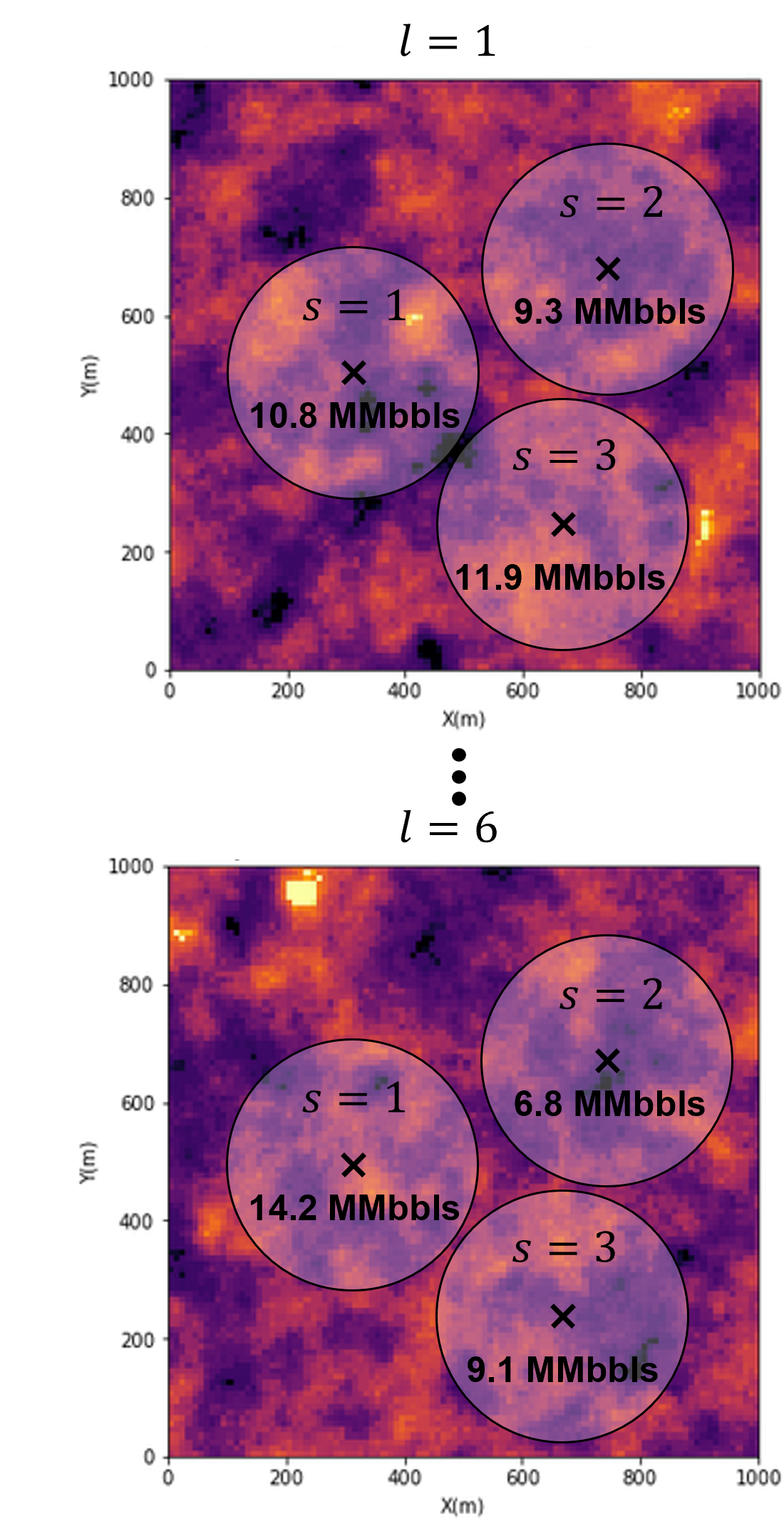

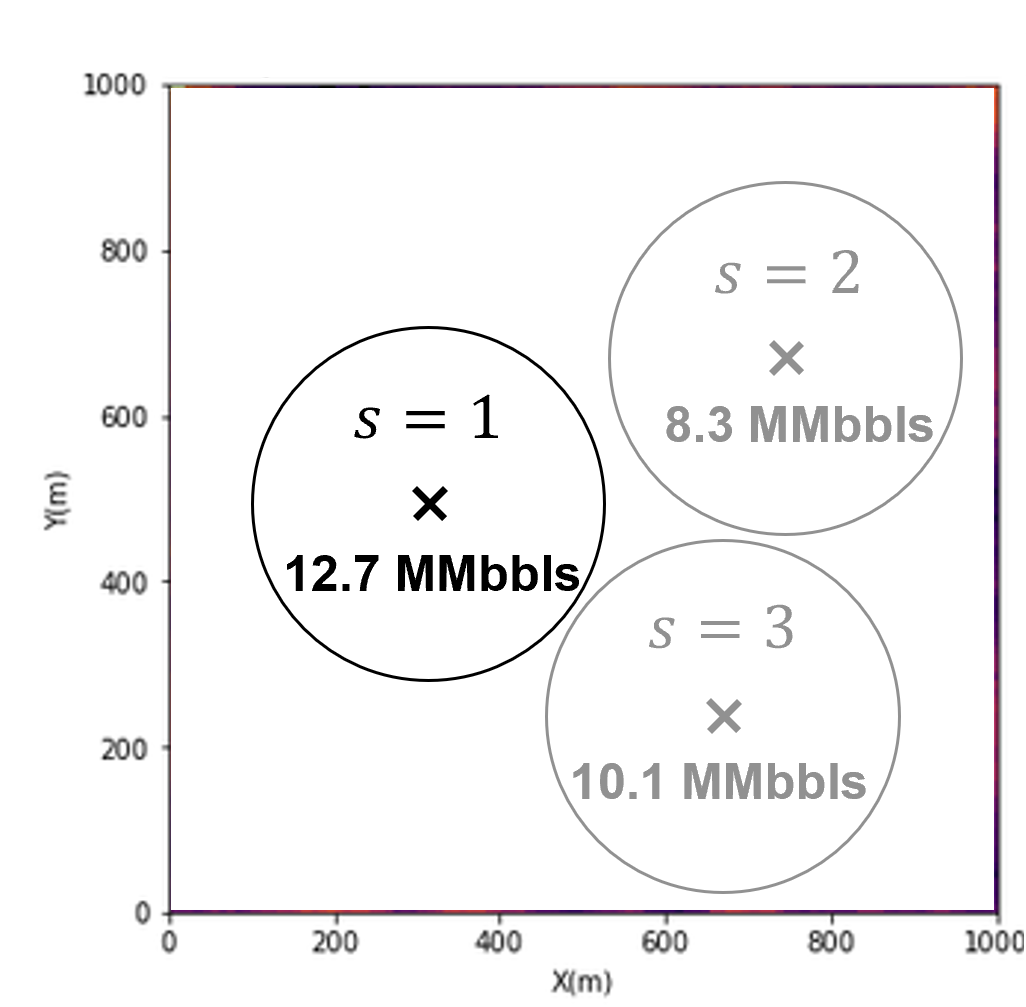

These are the steps in the expected profit workflow for optimum decision making in the presence of uncertainty,

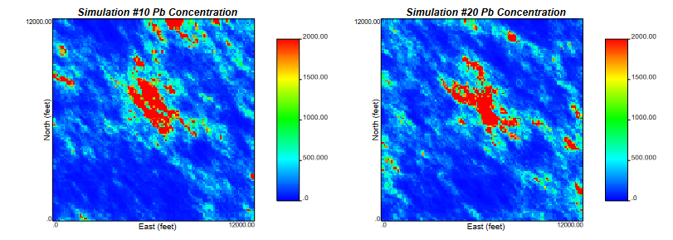

Calculate the uncertainty model, \(\ell = 1,\ldots,L\) subsurface realizations

Establish \(s = 1,\dots,S\) development scenarios

Establish \(P\) profit metric

Calculate profit, \(P\), over all \(L\) and \(S\)

Calculate the expected profit for each development scenario, \(E\{P(S)\}\)

Select the \(𝑠\) development scenario that maximizes expected profit.

Now we walk through each of these steps and provide more details.

The Uncertainty Model#

Calculate the uncertainty model, \(\ell = 1,\ldots,L\), subsurface models. This includes,

Scenarios - change the model inputs, and assumptions to capture uncertainty in the modeling decisions

Realizations - change the random number seed to capture spatial uncertainty

Multivariate - include all needed features, and their relations

The uncertainty model is represented by multiple models, scenarios and realizations, of the subsurface. For brevity, we just use the term subsurface realizations going forward.

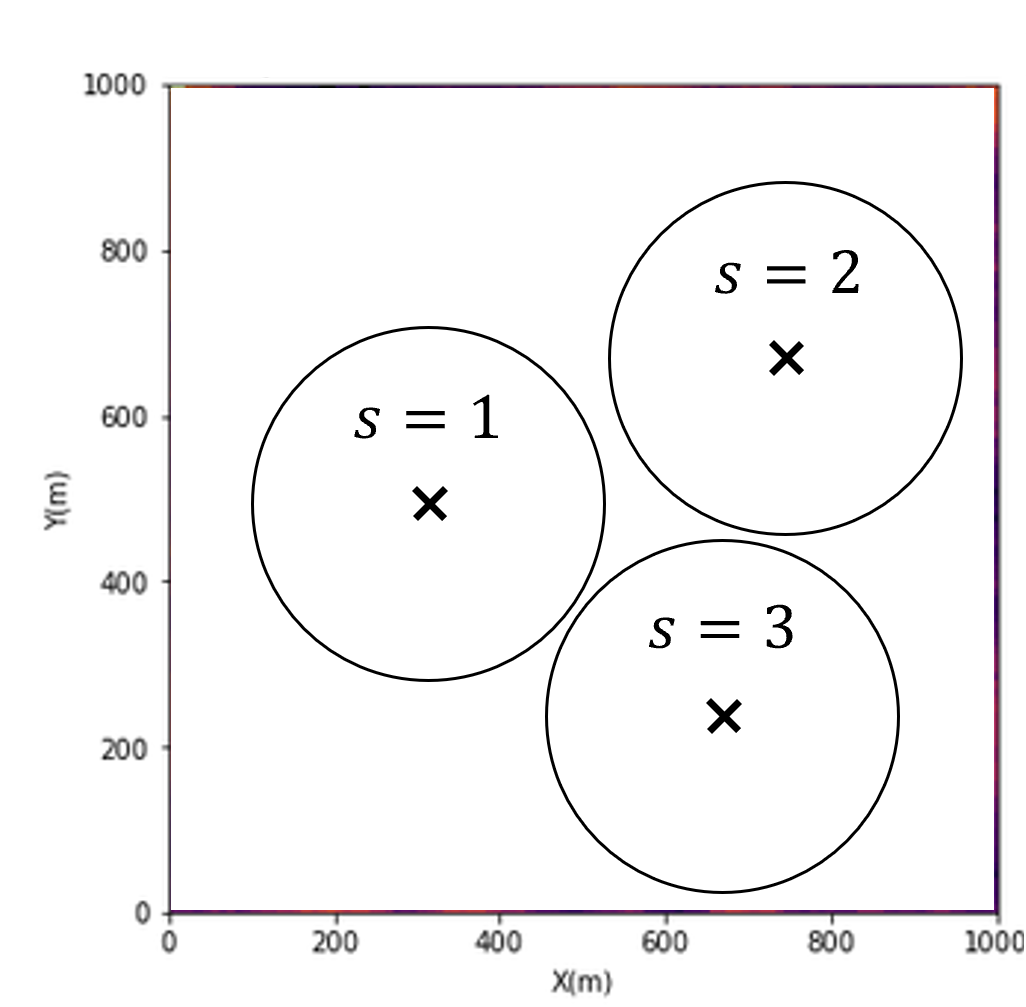

The Decision Scenarios#

Decision Scenario - discrete choices for developing the spatial, subsurface resource.

complete - each decision scenario includes all details needed to simulate extraction, for example, well locations, completion types, dig limits, mining block sequence

mutually exclusive - you can only make one choice, it is not possible to select 2 or more choices

exhaustive - all possible choices are included, there is no other choices available

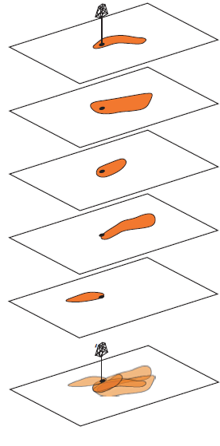

For an example of decision scenarios, consider 3 potential well locations with drainage radius,

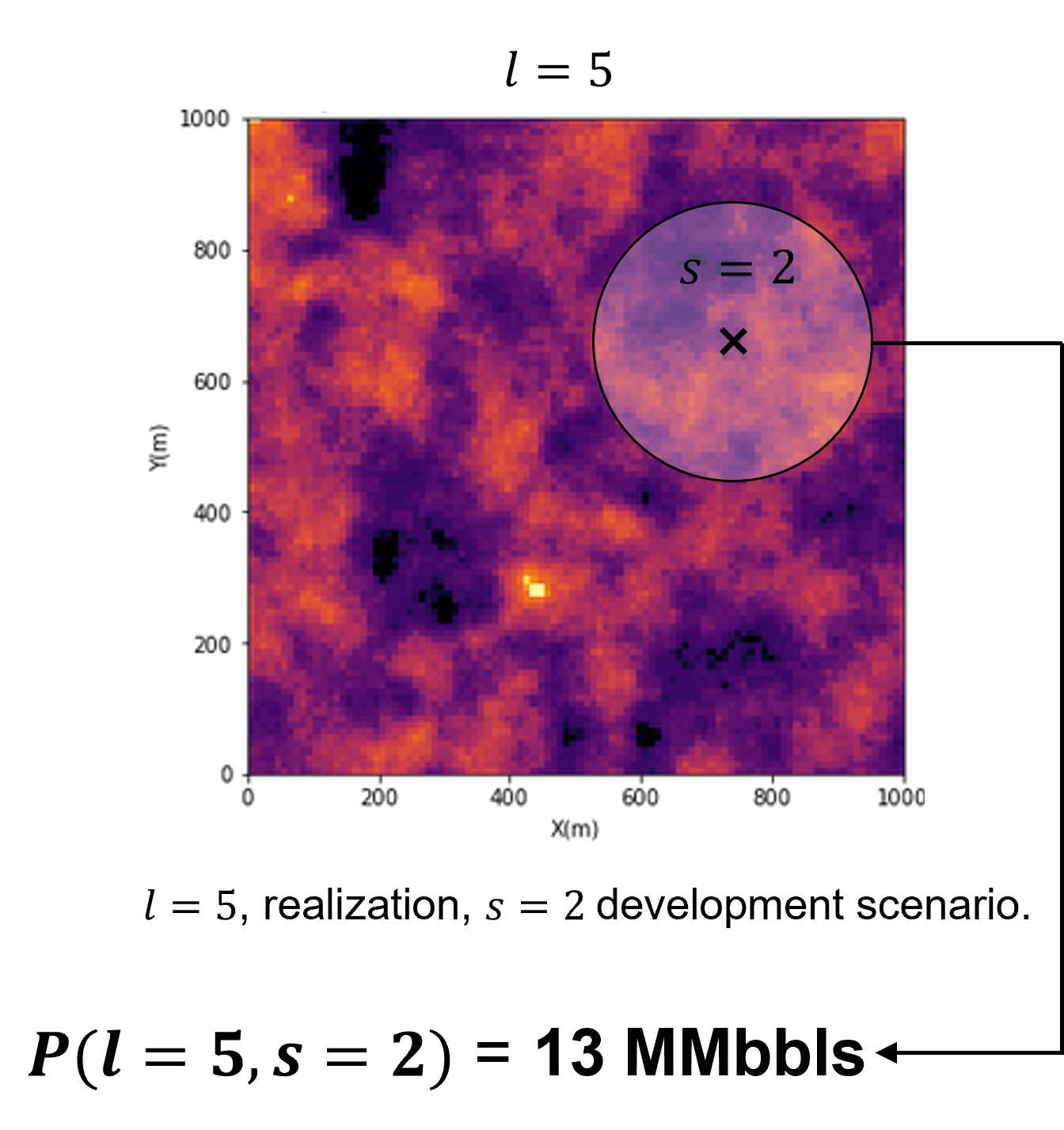

The Profit Metric#

The profit metric is,

a transfer function to map from spatial realizations, \(\ell\), and decision scenario, \(s\), to a value metric, \(P(\ell,s)\)

is in the units of the thing are we trying to maximize. For example, net present value, tonnage contaminant removed from soil, or volume of resource recovered

We calculate profit over all \(L\) subsurface realizations, and \(S\) decision scenarios. If computational feasible, we work with the,

full combinatorial of \(L\) subsurface realizations and \(S\) decision scenarios, \(P(\ell = 1,\ldots,L,s=1,\ldots,S)\)

Expected Profit#

To integrate the uncertainty model, we calculate expected profit \(E\{P(S)\}\)

expected profit is a probability, \(\lambda_l\), weighted average of profit over subsurface uncertainty

if all models are equiprobable, this simplifies to,

Maximize Expected Profit#

Now we maximize the expected profit \(E\{P(S)\}\),

calculate the expected profit for all decision scenarios, \(s = 1,\ldots, S\)

select the development scenario, \(s\), that maximizes expected profit over the subsurface realizations, \(L\), represented as,

This is the fundamental workflow for making an optimum decision in the presence of uncertainty.

Below we demonstrate this approach to select a single estimate from an uncertainty distribution. But, let’s first talk about uncertainty.

How do we make optimum estimates in the presence of uncertainty?

we cannot provide an uncertainty distribution to operations for decision making.

we must provide a single estimate. We must choose a single estimate in the presence of uncertainty

Let’s think about making this single estimate, we could just choose the average, expectation assuming equal probability for each outcome.

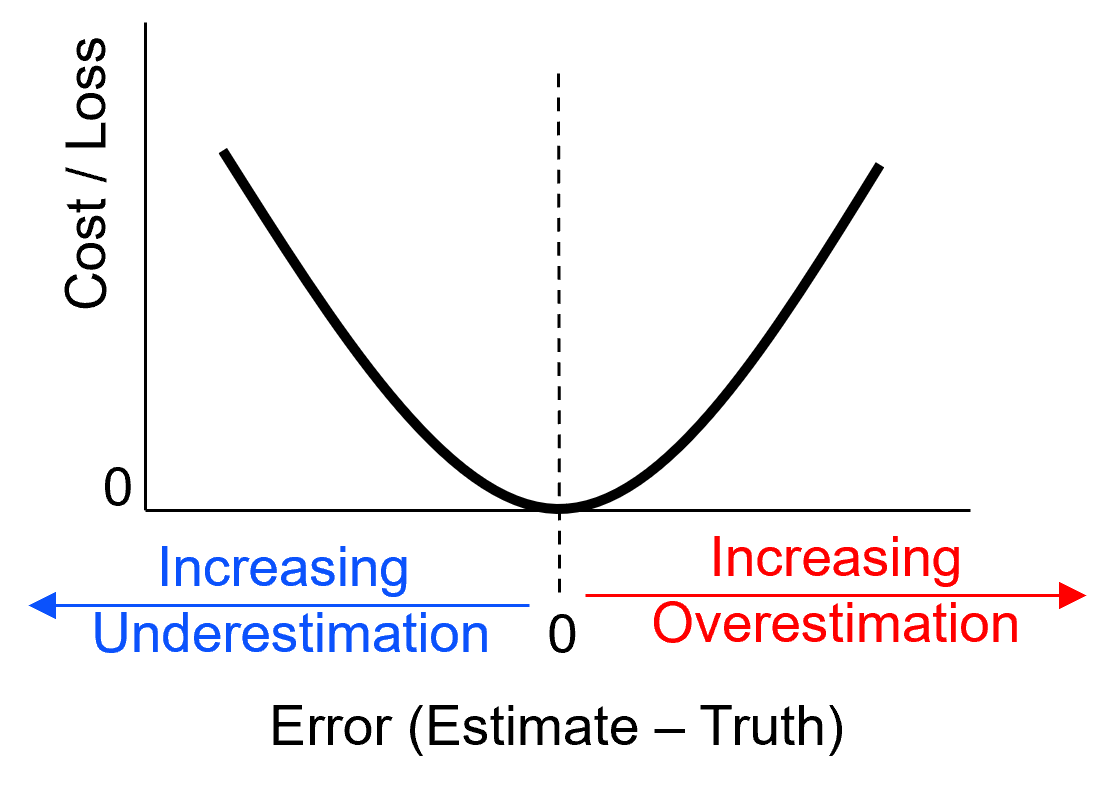

The expectation estimate assumes the cost of under- and over-estimation is symmetric and squared, i.e., the squared loss L2 norm

Risk Adverse – cost of overestimation > cost of underestimation

Risk Seeking – cost of overestimation < cost of underestimation

Let’s formalize this with the concept of loss functions.

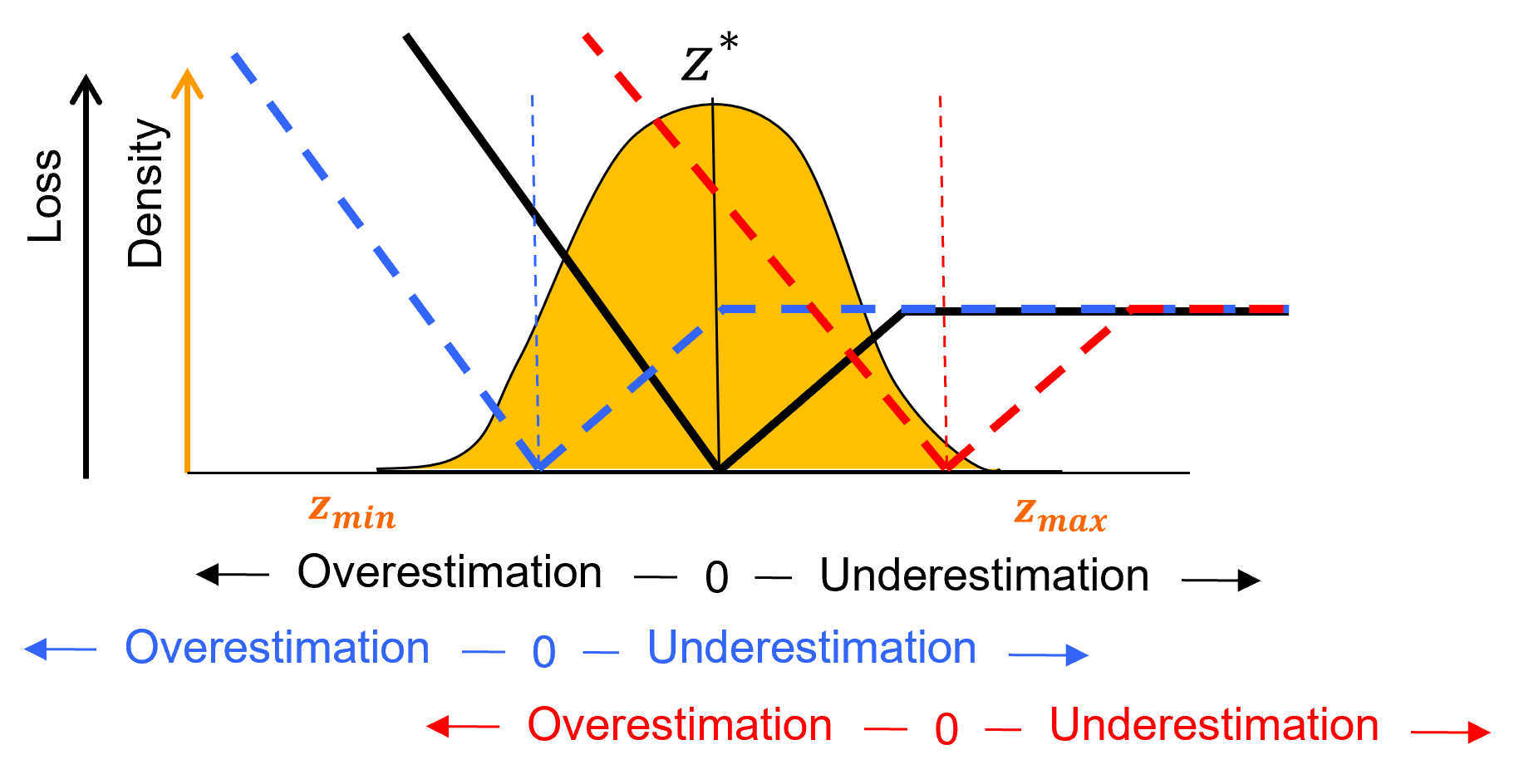

Loss Functions#

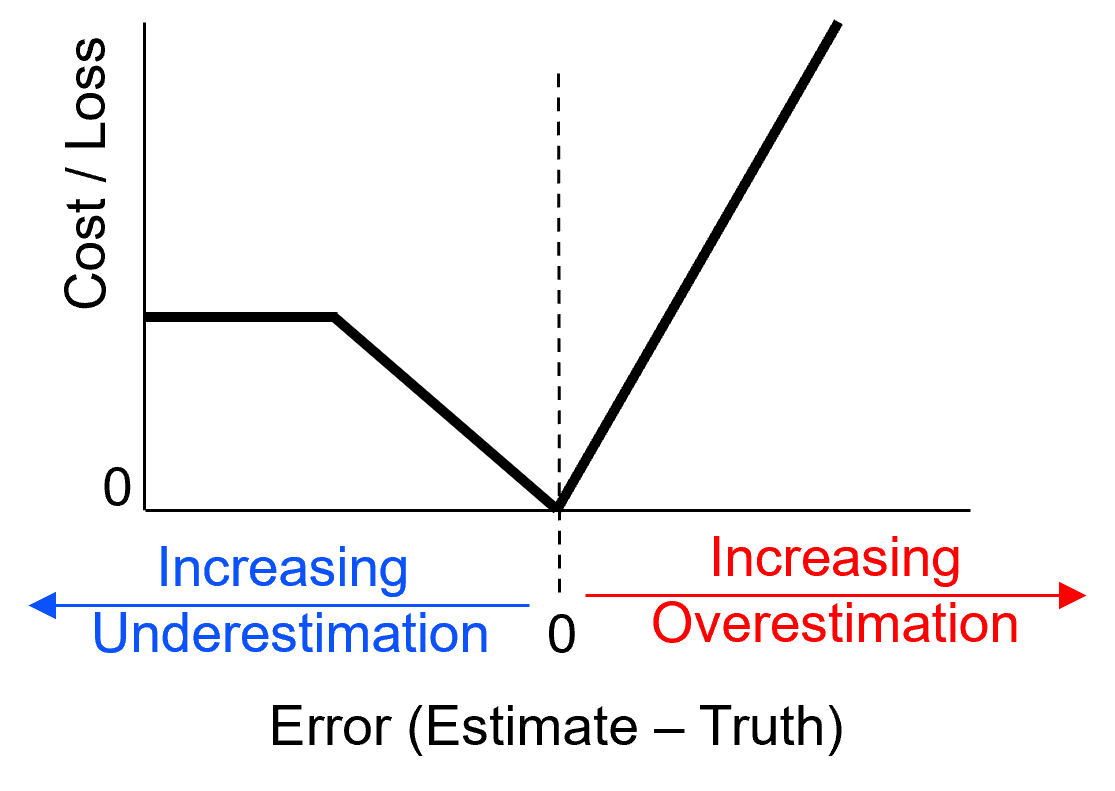

To make a decision in the presence of uncertainty we need to quantify the loss function,

loss due to over- and underestimation of the true value

no loss if the estimate is correct, i.e., if Estimate – Truth = 0

Note: estimating with the mean minimizes the quadratic loss function

Here’s the L2 loss, symmetric and increasing with the square away from 0, perfectly accurate prediction,

For a more complicated example, overestimation is more costly than underestimation and at some threshold underestimation any further has no more cost,

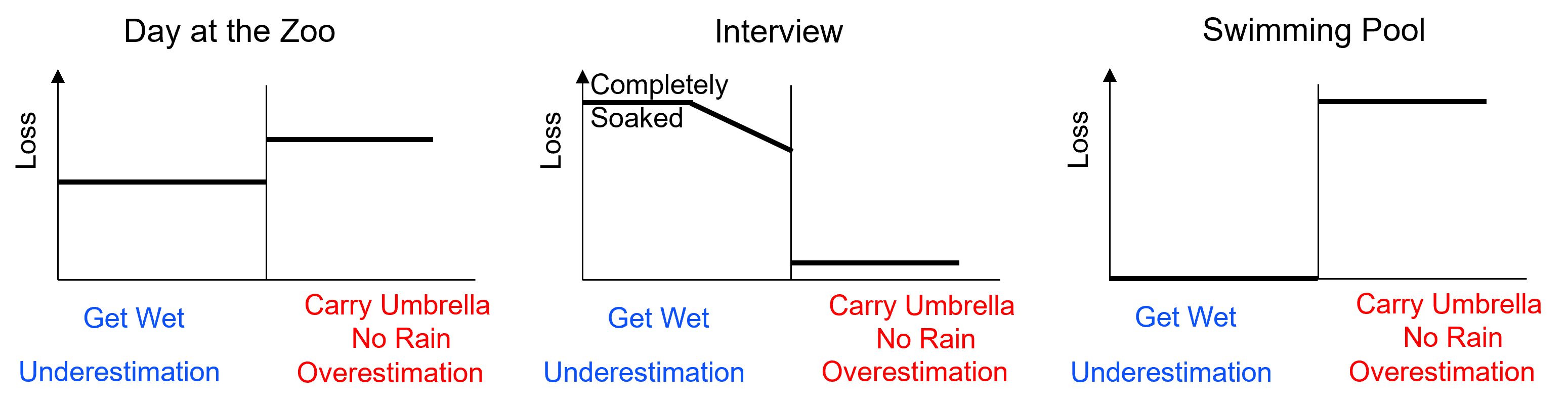

To further illustrate loss functions, consider the loss function to support the decision to carry an umbrella given uncertainty in the weather, rain or no rain from Professor Clayton Deutsch’s geostatistics course.

Overestimation - you estimate rain, but no rain happens

Underestimation = you estimate no rain, but rain happens

Should you carry an umbrella? The loss function depend on where you are going?

Decision Making with Loss Functions#

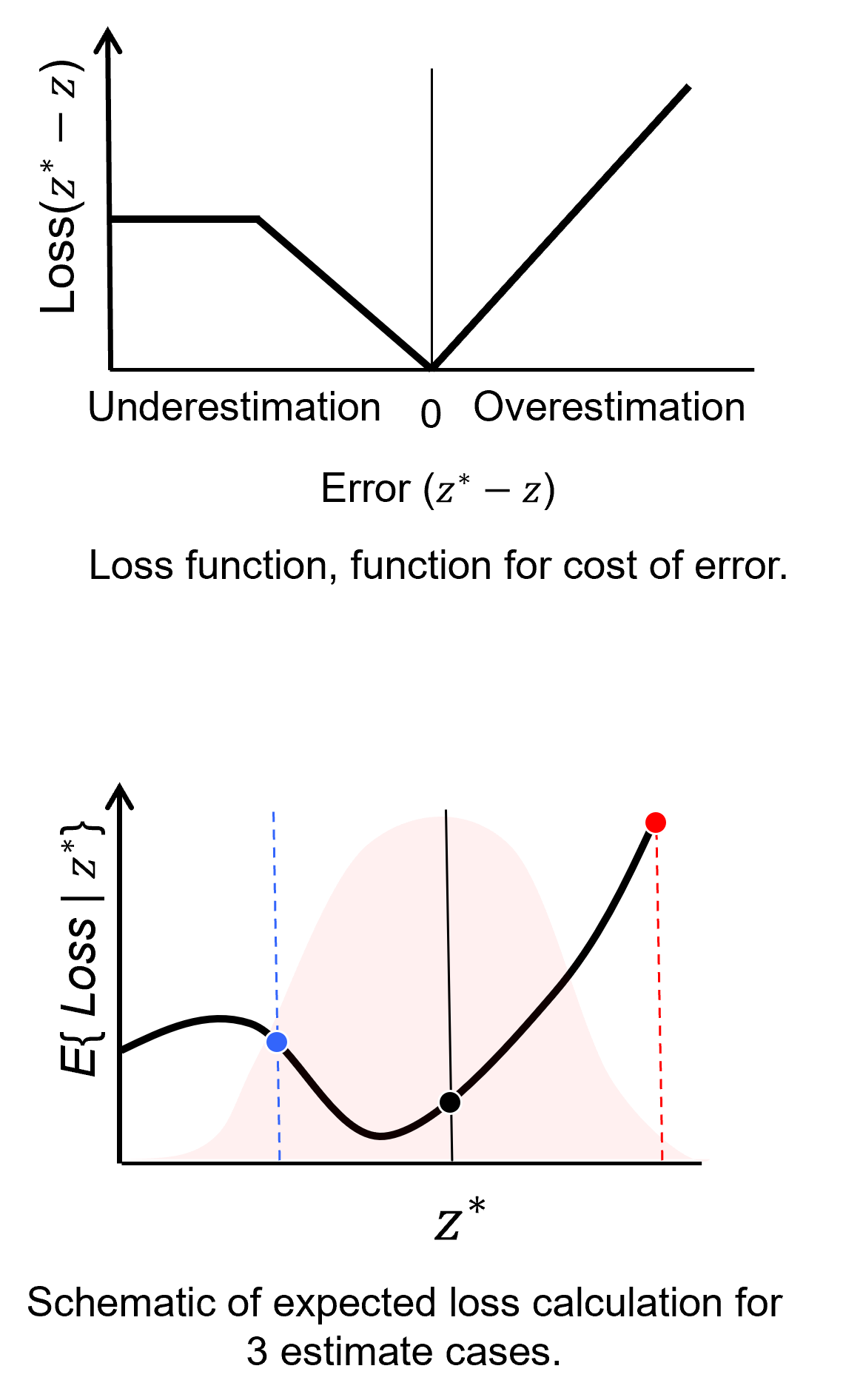

This is the workflow for decision making in the presence of uncertainty,

quantify cost of over- and underestimation in a loss function

apply loss function to the random variable of interest for a range of estimates

calculate the expected loss for each estimate

make the decision that minimizes loss

To understand the change in expected profit over different estimates, let’s put the flipped loss on the uncertainty distribution.

Now we can explain the results,

the estimate (black) is the lowest because the mode of the uncertainty distribution (highest probability) includes the lowest loss portions of the loss function.

the estimate (red) is the highest because the cost of over estimation is more costly and the entire uncertainty distribution is in the over estimated portion of the loss function

the estimate (blue) is quite low, but the cost of underestimation levels off, so the loss is not that high

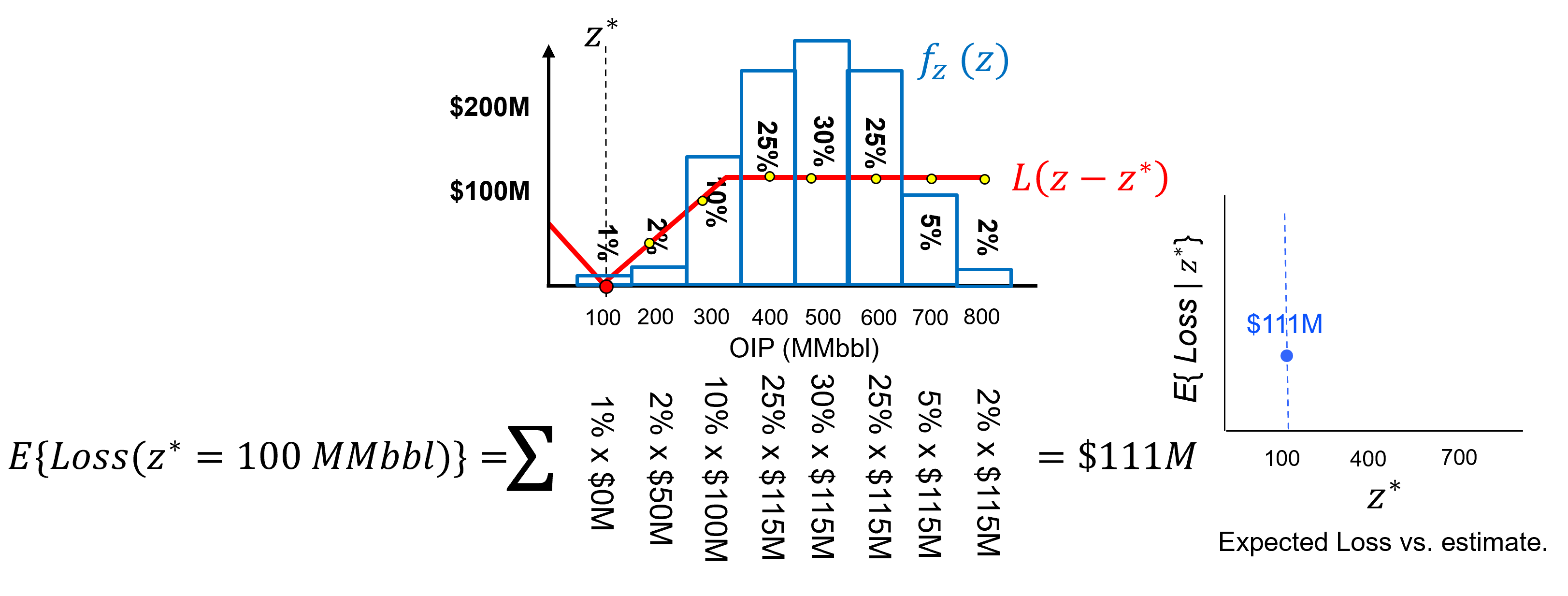

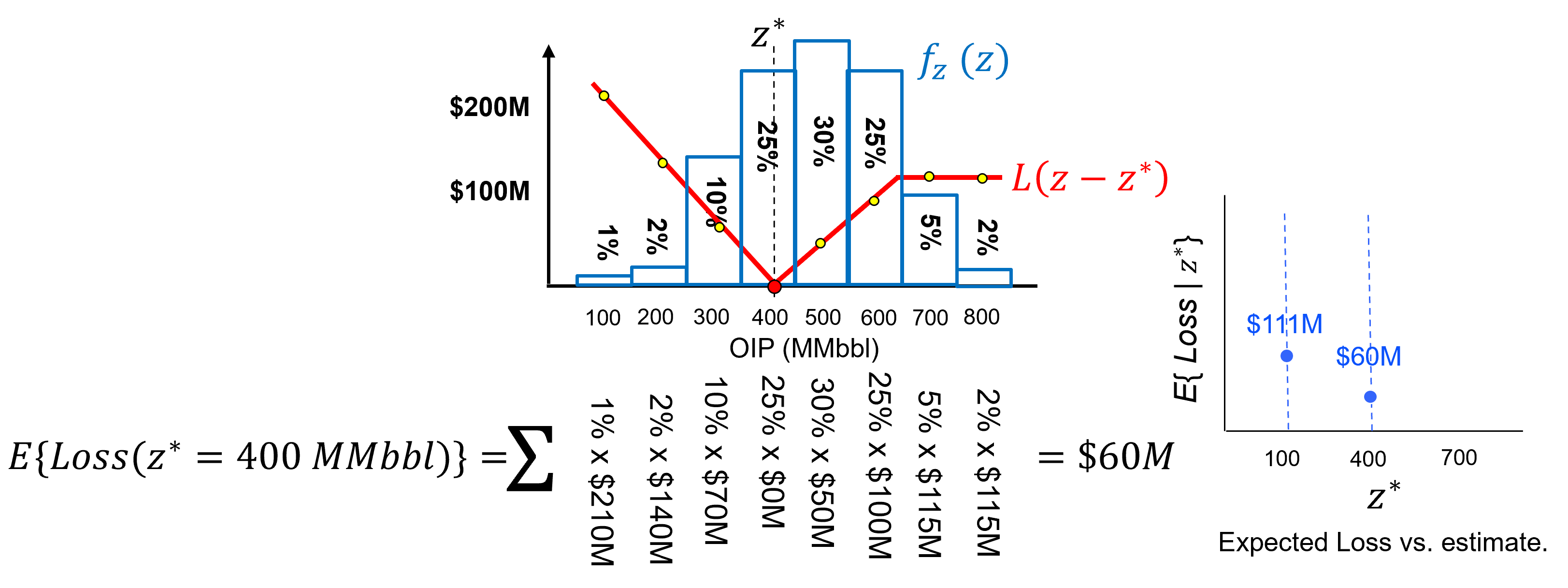

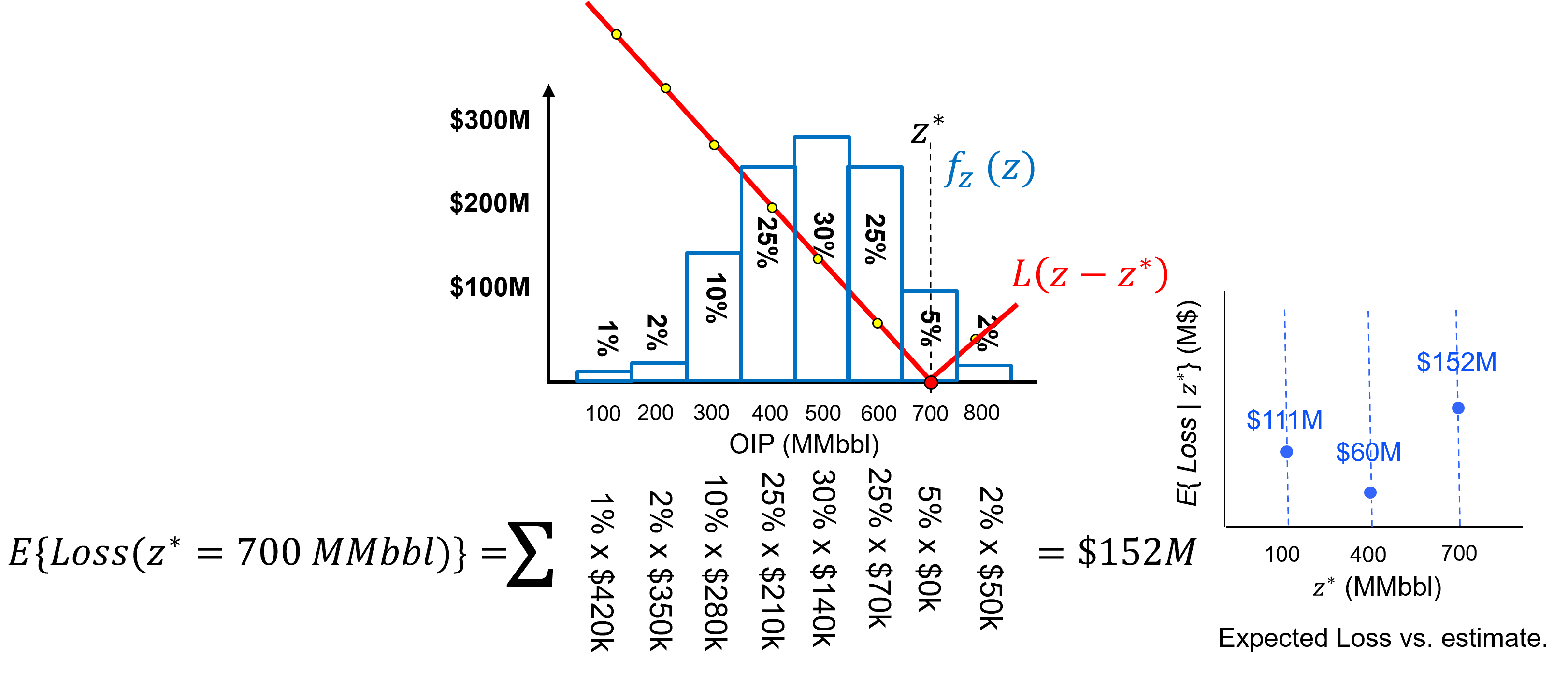

Let’s actually demonstrate the calculation of expected loss for a discrete case, we turn the uncertainty model into a normalized histogram with probability to be in each bin,

Now we can calculate the expected loss for an estimate of 100 MMbbl as,

and the expected loss for an estimate of 400 MMbbl as,

and the expected loss for an estimate of 700 MMbbl as,

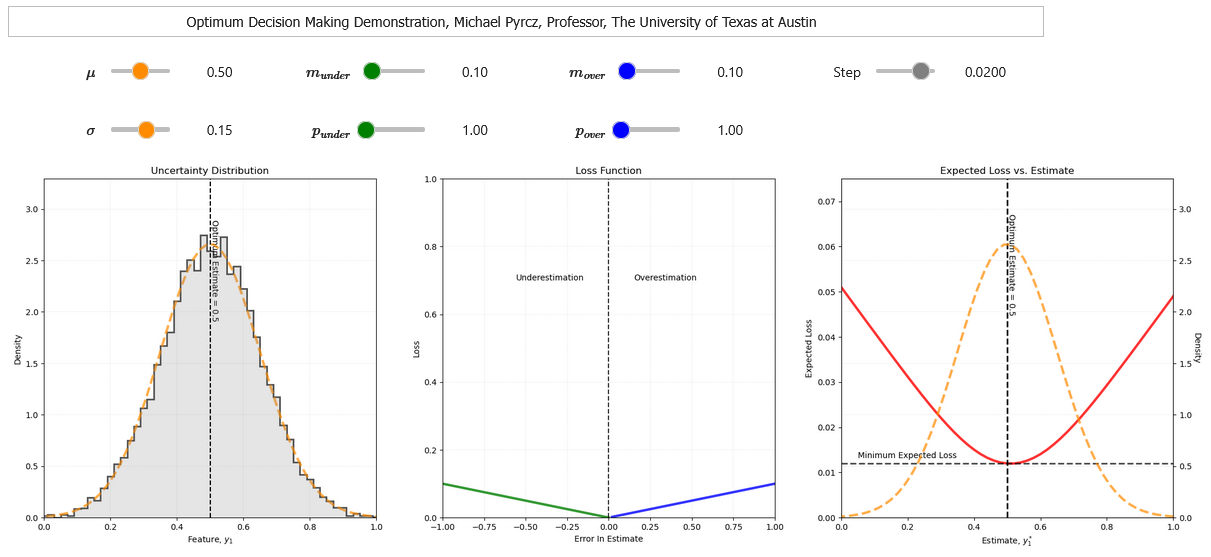

To demonstrate this, I built out an interactive dashboard for decision making in the presence of uncertainty.

this will not render in the book, so in the future I will add static examples for the book.

here is the interactive dashboard.

Load the Required Libraries#

The following code loads the required libraries.

import geostatspy.GSLIB as GSLIB # GSLIB utilies, visualization and wrapper

import geostatspy.geostats as geostats # GSLIB methods convert to Python

We will also need some standard packages. These should have been installed with Anaconda 3.

ignore_warnings = True # ignore warnings?

import numpy as np # ndarrys for gridded data

import pandas as pd # DataFrames for tabular data

import os # set working directory, run executables

import matplotlib.pyplot as plt # for plotting

from matplotlib.ticker import (MultipleLocator, AutoMinorLocator) # control of axes ticks

from matplotlib.ticker import FuncFormatter

from scipy.interpolate import Rbf # countours that extrapolate

from scipy.signal import convolve2d # convolution

from scipy.interpolate import griddata

from scipy.ndimage import gaussian_filter

import random

cmap = plt.cm.inferno

plt.rc('axes', axisbelow=True) # plot all grids below the plot elements

if ignore_warnings == True:

import warnings

warnings.filterwarnings('ignore')

seed = 13 # set ramdon number seed

cmap = plt.cm.inferno

If you get a package import error, you may have to first install some of these packages. This can usually be accomplished by opening up a command window on Windows and then typing ‘python -m pip install [package-name]’. More assistance is available with the respective package docs.

Declare Functions#

These are some conveneince functions for more readable code in our workflows.

def add_grid2():

plt.gca().grid(True, which='major',linewidth = 1.0); plt.gca().grid(True, which='minor',linewidth = 0.2) # add y grids

plt.gca().tick_params(which='major',length=7); plt.gca().tick_params(which='minor', length=4)

plt.gca().xaxis.set_minor_locator(AutoMinorLocator()); plt.gca().yaxis.set_minor_locator(AutoMinorLocator()) # turn on minor ticks

def add_grid(sub_plot):

sub_plot.grid(True, which='major',linewidth = 1.0); sub_plot.grid(True, which='minor',linewidth = 0.2) # add y grids

sub_plot.tick_params(which='major',length=7); sub_plot.tick_params(which='minor', length=4)

sub_plot.xaxis.set_minor_locator(AutoMinorLocator()); sub_plot.yaxis.set_minor_locator(AutoMinorLocator()) # turn on minor ticks

def generate_gaussian_fields(L, ny, nx): # Generate L random 2D Gaussian fields (white noise).

return np.random.randn(L, ny, nx)

def circular_kernel(radius): # Create a 2D circular kernel of a given radius.

size = int(2 * radius + 1)

y, x = np.ogrid[-radius:radius+1, -radius:radius+1]

mask = x**2 + y**2 <= radius**2

kernel = np.zeros((size, size))

kernel[mask] = 1

kernel /= np.sum(kernel) # Normalize

return kernel

def convolve_fields(fields, kernel): # Convolve each 2D field with the given kernel.

L, ny, nx = fields.shape

convolved_fields = np.empty_like(fields)

for i in range(L):

convolved_fields[i] = convolve2d(fields[i], kernel, mode='same', boundary='wrap')

return convolved_fields

def generate_sample_locations(xmin, xmax, ymin, ymax, nx, ny): # array of [sample_index, y, x] for a grid with samples

dx = (xmax - xmin) / nx

dy = (ymax - ymin) / ny

x = np.linspace(xmin + dx/2, xmax - dx/2, nx)

y = np.linspace(ymin + dy/2, ymax - dy/2, ny)

xv, yv = np.meshgrid(x, y)

x_flat = xv.ravel()

y_flat = yv.ravel()

samples = np.stack([y_flat, x_flat], axis=1)

return samples, xv, yv

def average_within_radius(grid, x, y, p, domain_size=1000): # Compute average of cells within p meters from point (x, y), flipped Y-axis

ny, nx = grid.shape

dx = domain_size / nx

dy = domain_size / ny

# Convert (x, y) to fractional grid indices

ix_center = x / dx

iy_center = y / dy

# Flip Y-axis: adjust index range accordingly

j_center = ny - 1 - iy_center # flipped row index

# Bounding box in index space

i_min = int(max(0, np.floor(ix_center - p / dx)))

i_max = int(min(nx - 1, np.ceil(ix_center + p / dx)))

j_min = int(max(0, np.floor(j_center - p / dy)))

j_max = int(min(ny - 1, np.ceil(j_center + p / dy)))

# Index meshgrid

j_indices, i_indices = np.meshgrid(np.arange(j_min, j_max + 1),

np.arange(i_min, i_max + 1),

indexing='ij')

# Convert indices to physical coordinates

x_coords = (i_indices + 0.5) * dx

y_coords = (ny - j_indices - 0.5) * dy # Flip Y-axis

# Distance from target point

distances = np.sqrt((x_coords - x)**2 + (y_coords - y)**2)

# Mask and average

mask = distances <= p

values_within_radius = grid[j_indices[mask], i_indices[mask]]

if values_within_radius.size == 0:

return np.nan

else:

return np.mean(values_within_radius)

Maximizing the Expected Profit Example#

Here is a practical demonstration of decision making in the presence of uncertainty with expected profit over multiple realizations, \(\ell = 1,\ldots,L\) and decision scenarios, \(s = 1,\ldots,S\),

calculate \(L\) realizations to characterize uncertianty.

specify \(S\) possible choices.

specify the profit function, \(P(\ell,s)\).

calculate the expected profit over all possible choices, $E{

select the \(s\) decision scenario that maximizes the profit.

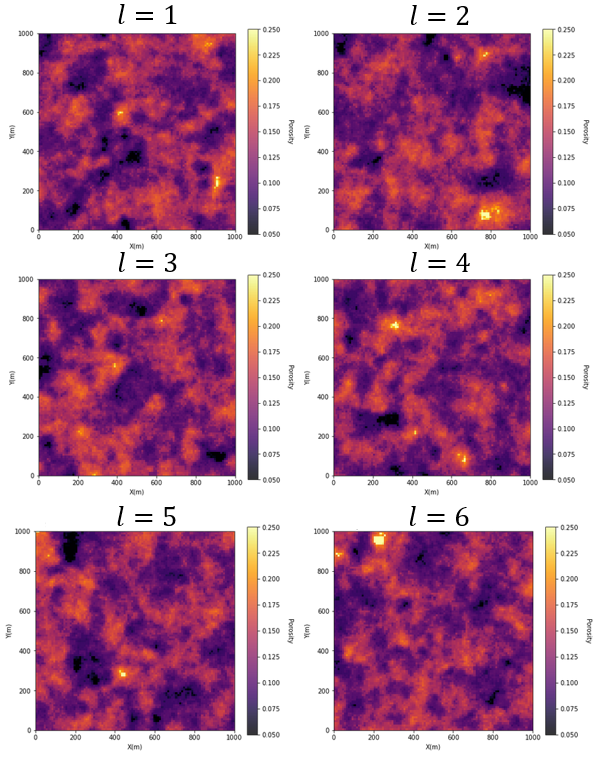

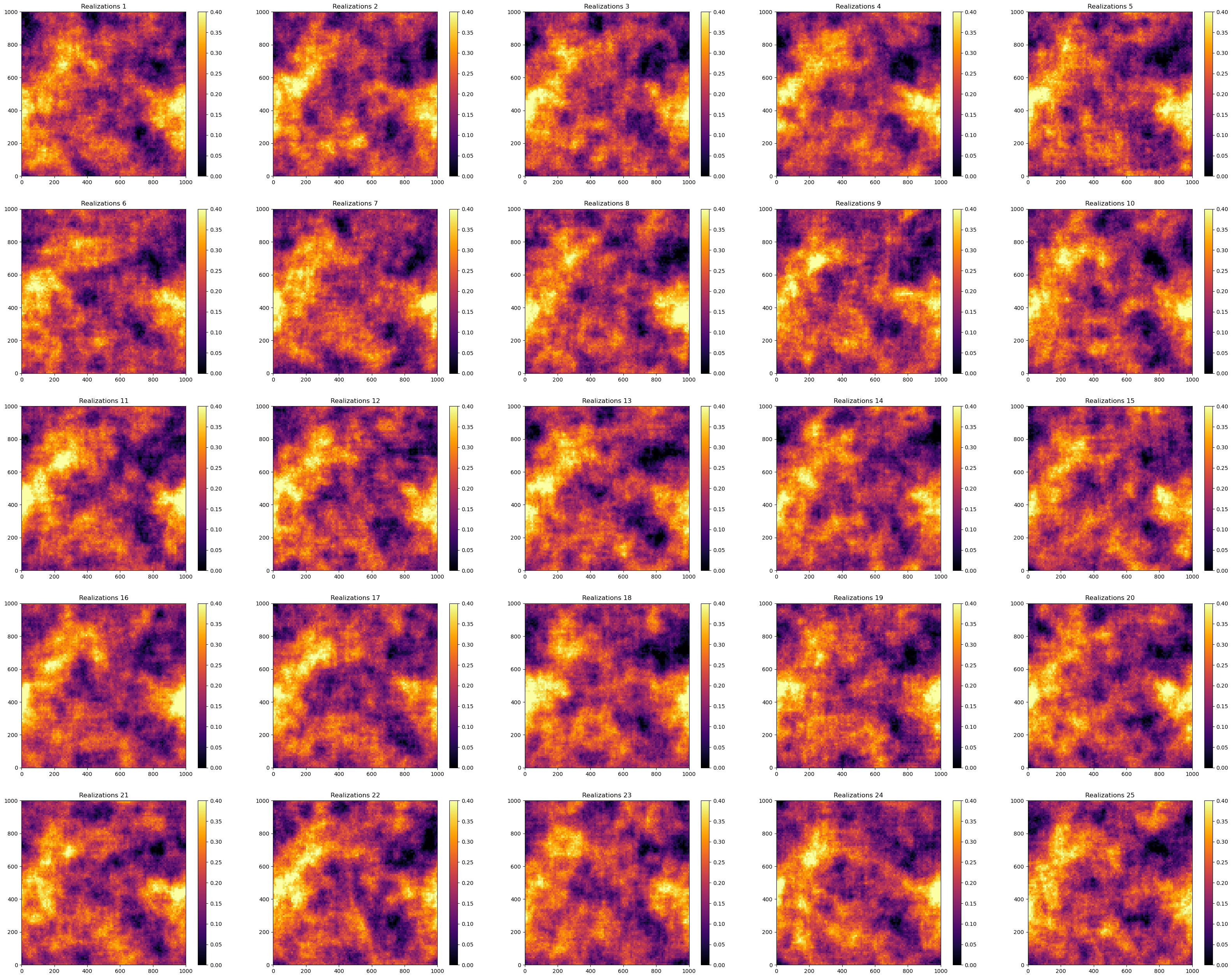

First let’s make the realizations for our uncertainty model. For efficiency we use a convolution model.

stochastic trend (deterministic given a set random number seed) + stochastic residual

np.random.seed(seed = seed) # set random seed

xmin = 0.0; xmax = 1000.0; ymin = 0.0; ymax = 1000.0; vmin = 0.0; vmax = 0.4; nw = 5

S = nw * nw

L = 25; ny, nx = 100, 100; r = 5; r_trend = 15 # number of realizations, model size, and kernel radius

smoothed_fields_trend = np.zeros((L,ny,nx))

trend = generate_gaussian_fields(1, ny, nx)

kernel_trend = circular_kernel(r_trend)

trend = convolve_fields(trend, kernel_trend)

trend = GSLIB.affine(trend.flatten(),0.2,0.07).reshape(ny,nx)

fields = generate_gaussian_fields(L, ny, nx) # generate and convolve fields

kernel = circular_kernel(r) # make kernel to impose spatial continuity by convolution

smoothed_fields = convolve_fields(fields, kernel)

fields = generate_gaussian_fields(L, ny, nx) # generate and convolve fields

kernel = circular_kernel(r) # make kernel to impose spatial continuity by convolution

smoothed_fields = convolve_fields(fields, kernel)

for l in range(0,L): # correct mean and variance

smoothed_fields[l] = GSLIB.affine(smoothed_fields[l].flatten(),0.0,0.04).reshape(ny,nx)

smoothed_fields_trend[l] = smoothed_fields[l] + trend

for i in range(1,L+1): # visualize all the realizations

plt.subplot(5, 5, i)

plt.title("Realizations " + str(i))

plt.imshow(smoothed_fields_trend[i-1], cmap=cmap,extent = [xmin,xmax,ymin,ymax],vmin = vmin, vmax = vmax)

plt.colorbar()

plt.tight_layout()

plt.subplots_adjust(left=0.0, bottom=0.0, right=5.0, top=5.1, wspace=0.05, hspace=0.2); plt.show()

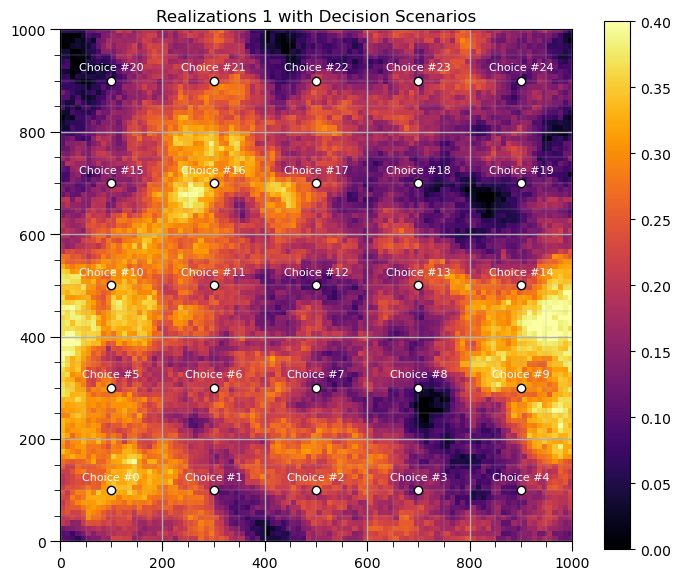

Now we can specify the decision scenarios

a 5 x 5 grid of potential well locations

scenarios, xv, yv = generate_sample_locations(xmin, xmax, ymin, ymax, nw, nw) # get the sample locations

plt.subplot(111) # visualize the decision scenarios with a single realization

plt.title("Realizations 1 with Decision Scenarios")

im = plt.imshow(smoothed_fields_trend[0], cmap=cmap,extent = [xmin,xmax,ymin,ymax],vmin = vmin, vmax = vmax)

plt.scatter(scenarios[:,1],scenarios[:,0],color='white',edgecolor = 'black')

for s in range(0,S):

plt.annotate('Choice #' + str(s),[scenarios[s,1],scenarios[s,0]+20],color= 'white',ha = 'center',fontsize=8)

plt.colorbar(im); plt.tight_layout(); add_grid2()

plt.subplots_adjust(left=0.0, bottom=0.0, right=1.0, top=1.1, wspace=0.05, hspace=0.2); plt.show()

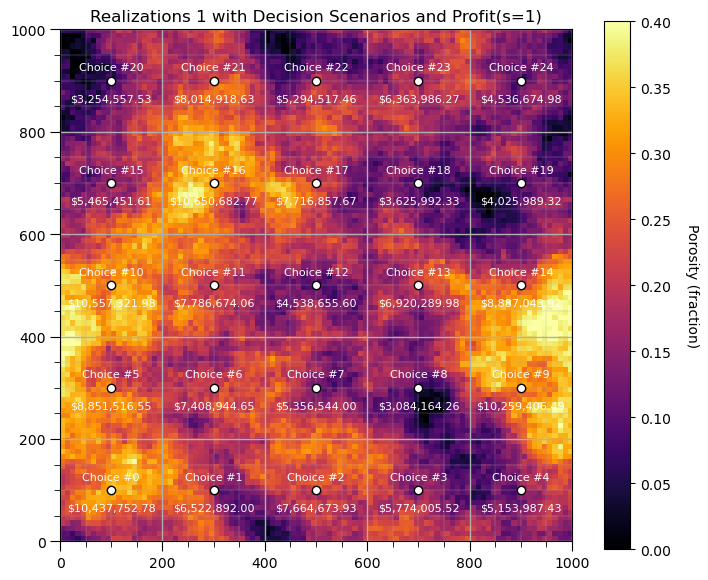

Now we specfy a simple profit calculation. Value in US$ for hydrocarbon extracted from the well assuming,

all rock with in 50 meters is drained perfectly

the porosity is completely full of hydrocarbon, i.e., oil saturation is 100%

10 m uniform reservoir thickness

6.28981 barrels / m^3

$70.0 / barrel

Let’s run this on only the first realization and add the profit for just this realization on the map.

radius = 50.0 # select the drainage radius

thickness = 10.0 # select the reservoir thickness

profit_onereal = np.zeros((S))

for s in range(0,S):

profit_onereal[s] = average_within_radius(smoothed_fields_trend[0], x=scenarios[s,1],y=scenarios[s,0], p=radius, domain_size=1000)

profit_onereal[s] = profit_onereal[s] * np.pi * radius * radius * thickness * 6.28981 * 70.0

plt.subplot(111)

plt.title("Realizations 1 with Decision Scenarios and Profit(s=1)")

im = plt.imshow(smoothed_fields_trend[0], cmap=cmap,extent = [xmin,xmax,ymin,ymax],vmin = vmin, vmax = vmax)

plt.scatter(scenarios[:,1],scenarios[:,0],color='white',edgecolor = 'black')

for s in range(0,S):

plt.annotate('Choice #' + str(s),[scenarios[s,1],scenarios[s,0]+20],color= 'white',ha = 'center',fontsize=8)

label = f"${np.round(profit_onereal[s],2):,.2f}"

plt.annotate(str(label),[scenarios[s,1],scenarios[s,0]-40],color= 'white',ha = 'center',fontsize=8)

plt.tight_layout(); add_grid2()

cbar = plt.colorbar(im, orientation="vertical"); cbar.set_label('Porosity (fraction)', rotation=270, labelpad=20)

plt.subplots_adjust(left=0.0, bottom=0.0, right=1.0, top=1.1, wspace=0.05, hspace=0.2); plt.show()

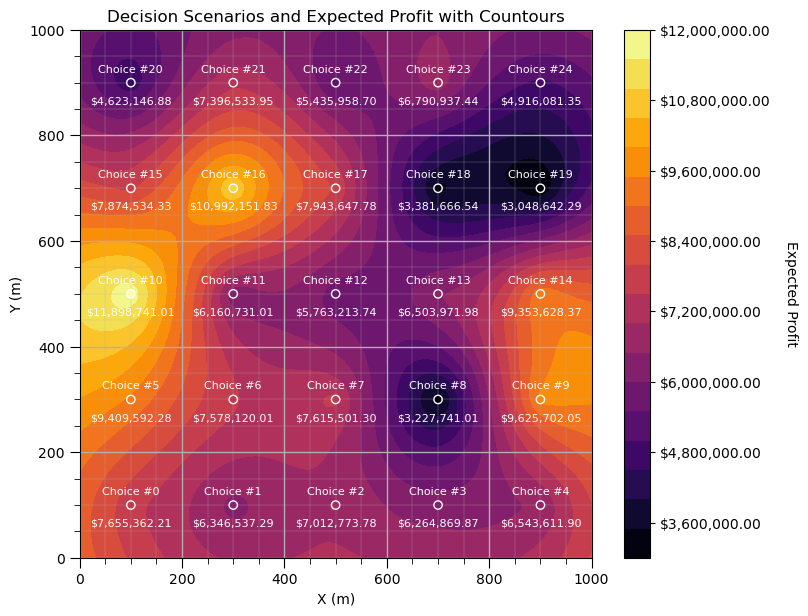

Now we calculate the expected profit over all realizations.

profit = np.zeros((L,S))

for l in range(0,L):

for s in range(0,S):

profit[l,s] = average_within_radius(smoothed_fields_trend[l], x=scenarios[s,1],y=scenarios[s,0], p=radius, domain_size=1000)

profit[l,s] = profit[l,s] * np.pi * radius * radius * 10.0 * 6.28981 * 70.0

expected_profit = np.average(profit,axis = 0)

plt.subplot(111)

plt.title("Decision Scenarios and Expected Profit with Countours")

sc = plt.scatter(scenarios[:,1],scenarios[:,0],c=expected_profit,edgecolor = 'white',cmap=cmap,zorder=100)

for s in range(0,S):

plt.annotate('Choice #' + str(s),[scenarios[s,1],scenarios[s,0]+20],color= 'white',ha = 'center',fontsize=8,zorder=100)

label = f"${np.round(expected_profit[s],2):,.2f}"

plt.annotate(str(label),[scenarios[s,1],scenarios[s,0]-40],color= 'white',ha = 'center',fontsize=8,zorder=100)

x_grid = np.linspace(xmin, xmax, 100) # higher resolution grid between xmin and xmax

y_grid = np.linspace(ymin, ymax, 100) # higher resolution grid between ymin and ymax

X, Y = np.meshgrid(x_grid, y_grid)

rbf = Rbf(xv.flatten(), yv.flatten(), expected_profit, function='linear') # or 'multiquadric', 'thin_plate', etc.

Z = rbf(X, Y) # works on full grid

ct = plt.contourf(X, Y, Z,levels=20, cmap=cmap,zorder=0)

cbar = plt.colorbar(ct,orientation="vertical", ticks=np.linspace(0, 12000000, 11)); plt.tight_layout()

formatter = FuncFormatter(lambda x, pos: f"${x:,.2f}")

cbar.set_label('Expected Profit', rotation=270, labelpad=20)

cbar.ax.yaxis.set_major_formatter(formatter)

plt.xlabel('X (m)'); plt.ylabel('Y (m)')

plt.xlim([xmin,xmax]); plt.ylim([ymin,ymax]); add_grid2()

plt.subplots_adjust(left=0.0, bottom=0.0, right=1.0, top=1.1, wspace=0.05, hspace=0.2); plt.show()

I have to admit, this turned out very cool. We can now produce a map of expected profit for each well location.

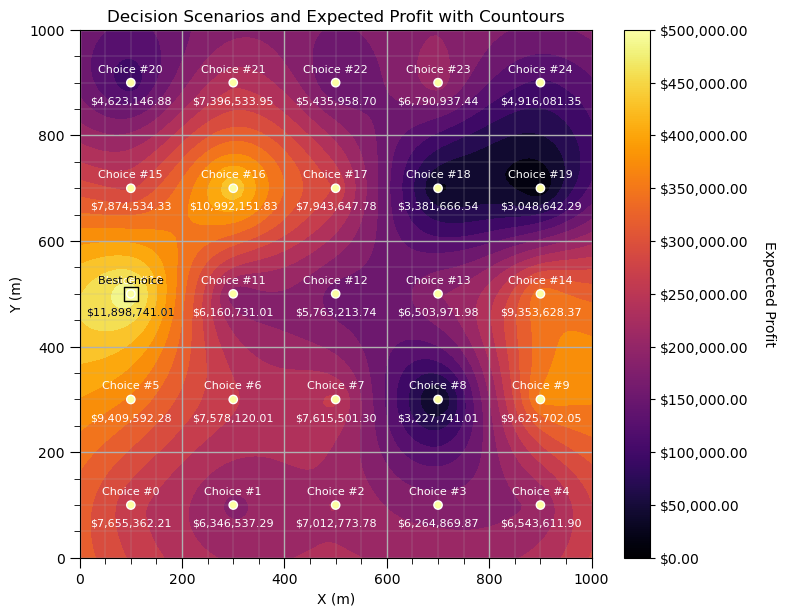

but ultimately we need to identify the next choice, so here is.

s_best = np.argmax(expected_profit) # get the best decision scenario

plt.subplot(111)

plt.title("Decision Scenarios and Expected Profit with Countours")

sc = plt.scatter(scenarios[:,1],scenarios[:,0],c=expected_profit,edgecolor = 'white',cmap=cmap,vmin = 0, vmax = 500000,zorder=100)

for s in range(0,S):

plt.annotate('Choice #' + str(s),[scenarios[s,1],scenarios[s,0]+20],color= 'white',ha = 'center',fontsize=8,zorder=100)

label = f"${np.round(expected_profit[s],2):,.2f}"

plt.annotate(str(label),[scenarios[s,1],scenarios[s,0]-40],color= 'white',ha = 'center',fontsize=8,zorder=100)

plt.scatter(scenarios[s_best,1],scenarios[s_best,0],c=expected_profit[s_best],s = 100,marker='s',

edgecolor = 'black',cmap=cmap,vmin = 0, vmax = 500000,zorder=50)

plt.annotate('Best Choice',[scenarios[s_best,1],scenarios[s_best,0]+20],color= 'black',ha = 'center',fontsize=8,zorder=200)

label = f"${np.round(expected_profit[s_best],2):,.2f}"

plt.annotate(str(label),[scenarios[s_best,1],scenarios[s_best,0]-40],color= 'black',ha = 'center',fontsize=8,zorder=200)

cbar = plt.colorbar(sc,orientation="vertical", ticks=np.linspace(0, 500000, 11)); plt.tight_layout()

formatter = FuncFormatter(lambda x, pos: f"${x:,.2f}")

cbar.set_label('Expected Profit', rotation=270, labelpad=20)

cbar.set_ticks(cbar.get_ticks()) # Ensure ticks are set

cbar.ax.yaxis.set_major_formatter(formatter)

x_grid = np.linspace(xmin, xmax, 100) # higher resolution grid between xmin and xmax

y_grid = np.linspace(ymin, ymax, 100) # higher resolution grid between ymin and ymax

X, Y = np.meshgrid(x_grid, y_grid)

rbf = Rbf(xv.flatten(), yv.flatten(), expected_profit, function='linear') # or 'multiquadric', 'thin_plate', etc.

Z = rbf(X, Y) # works on full grid

plt.contourf(X, Y, Z, levels=20, cmap=cmap,zorder=0) # plot a smooth map of expected profit

plt.xlabel('X (m)'); plt.ylabel('Y (m)')

plt.xlim([xmin,xmax]); plt.ylim([ymin,ymax]); add_grid2()

plt.subplots_adjust(left=0.0, bottom=0.0, right=1.0, top=1.1, wspace=0.05, hspace=0.2); plt.show()

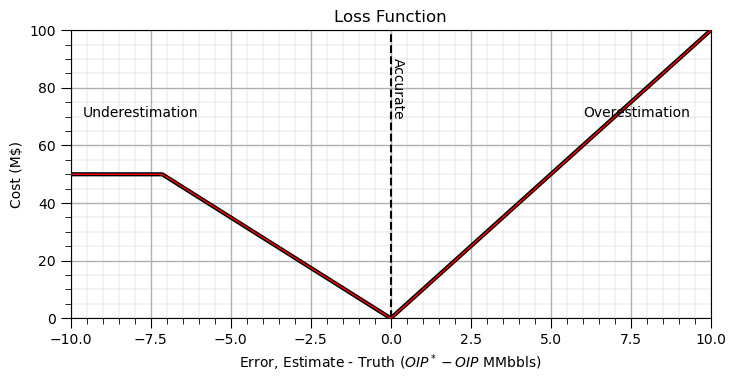

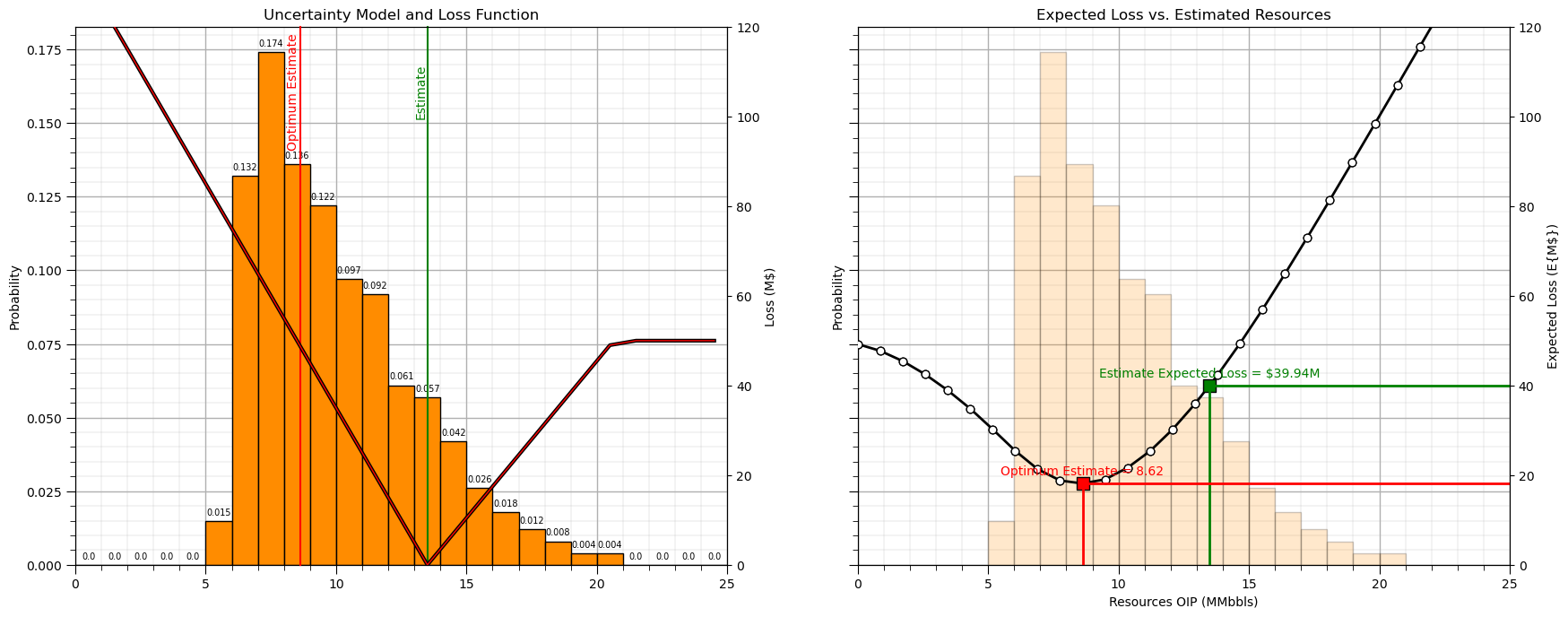

Optimum Estimate with a Loss Function Example#

Let’s start by parameterizing and plotting our loss function.

I designed a function similar to the illustrations above for loss due to over- or underestimation of hydrocarbon resources in millions of barrels.

for convenience, I made a function for my loss function, i.e., a loss function, function.

m_over = 10.0; m_under = 7.0; max_under = 50.0 # specify a simple piece-wise linear loss function

delta_values = np.arange(-10.0,10.0,0.02)

def loss_function(error,m_under,max_under,m_over): # loss function function (yes, I did this on purpose)

loss = np.where(error < 0.0, np.clip(-1*error * m_under,a_min= None,a_max = max_under),error * m_over)

return loss

loss_plot = loss_function(delta_values,m_under,max_under,m_over) # calculate loss over all possible estimates

plt.plot(delta_values,loss_plot,c='black',lw=3,zorder=1); plt.plot(delta_values,loss_plot,c='red',lw=1,zorder=10) # plot loss

plt.plot([0,0],[0,100],color='black',ls='--'); plt.annotate('Accurate',[0,70],rotation=270)

plt.annotate('Underestimation',[-6,70], rotation=0,horizontalalignment='right',zorder=10)

plt.annotate('Overestimation',[6,70], rotation=0,horizontalalignment='left',zorder=10)

plt.xlim([-10,10]); plt.ylim([0,100]); add_grid2(); plt.title('Loss Function'); plt.ylabel('Cost (M$)')

plt.xlabel(r'Error, Estimate - Truth ($OIP^*-OIP$ MMbbls)')

plt.subplots_adjust(left=0.0, bottom=0.0, right=1.0, top=0.6, wspace=0.05, hspace=0.2); plt.show()

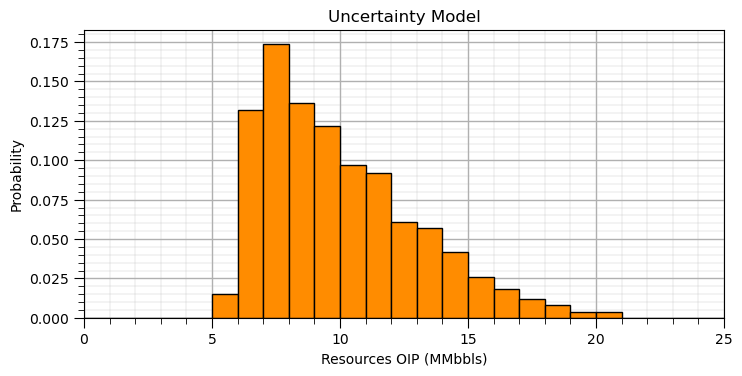

Distribution of Uncertainty#

Let’s assume a parametric uncertainty distribution for resources that we can easily modify to try out some different cases.

alpha = 1.5; beta = 7.0 # uncertainty model, parameters of the beta distribution

mean = 10.0; stdev = 3.0

uncertainty_samples = np.random.beta(a= alpha, b = beta, size = 1000) # draw samples

uncertainty_samples = GSLIB.affine(uncertainty_samples, mean, stdev) # correct the mean and standard deviation

prob,bin_edges, _ = plt.hist(uncertainty_samples,color='darkorange',edgecolor='black',bins = np.linspace(0,25,26),density = True); add_grid2()

bin_centroids = (bin_edges[:-1] + bin_edges[1:]) / 2

plt.xlim([0,25]); plt.xlabel('Resources OIP (MMbbls)'); plt.ylabel('Probability'); plt.title('Uncertainty Model')

plt.subplots_adjust(left=0.0, bottom=0.0, right=1.0, top=0.6, wspace=0.05, hspace=0.2); plt.show()

Calculate Expected Loss for an Estimate#

Now, let’s select a single estimate and calculate the expected loss.

we repeat the calculation for a range of estimates to also visualize the expected loss vs. estimate curve.

estimate = 13.5 # select and estimate for demonstration and visualization

fig, axs = plt.subplots(1, 2, figsize=(8, 6),sharey = True)

ax1 = axs[0]; ax2 = axs[1]

prob,bin_edges, _ = ax1.hist(uncertainty_samples,color='darkorange',edgecolor='black',bins = np.linspace(0,25,26),density = True);

add_grid(ax1)

bin_centroids = (bin_edges[:-1] + bin_edges[1:]) / 2

error = -1*(bin_centroids - estimate) # flip the loss function

loss_plot_est = loss_function(error,m_under,max_under,m_over)

ax1b = ax1.twinx() # plot uncertainty model, estimate and loss function anchored at estimate

ax1b.plot(bin_centroids,loss_plot_est,c='black',lw=3,zorder=9); ax1b.plot(bin_centroids,loss_plot_est,c='red',lw=1,zorder=10)

ax1b.axvline(x=estimate, color='green', clip_on=False); ax1b.annotate('Estimate',[estimate-0.5,100.0],color='green',rotation = 90.0)

ax1b.set_ylim([0.,120.]); add_grid(ax2)

plt.xlim([0,25]); plt.xlabel('Resources OIP (MMbbls)'); ax1.set_ylabel('Probability'); plt.title('Uncertainty Model and Loss Function')

ax1b.set_ylabel('Loss (M$)')

for ibin,bincenter in enumerate(bin_centroids):

ax1.annotate(np.round(prob[ibin],3),[bincenter,prob[ibin]+0.002], ha='center',size=7)

ax2.hist(uncertainty_samples,color='darkorange',edgecolor='black',bins = np.linspace(0,25,26),density = True,alpha=0.2);

ax2b = ax2.twinx()

expected_loss = np.dot(loss_plot_est,prob)

ax2b.scatter(estimate,expected_loss,marker='s',s=100,color='green',edgecolor='black',zorder=20)

ax2b.annotate('Estimate Expected Loss = $' + str(np.round(expected_loss,2)) + 'M',[estimate,expected_loss+2],ha='center',color='green',zorder=20)

ax2b.plot([estimate,estimate],[0,expected_loss],color='green',lw=2,zorder=30)

ax2b.plot([estimate,25],[expected_loss,expected_loss],color='green',lw=2,zorder=30)

ax2b.set_ylabel('Expected Loss (E{M$})'); ax2b.set_ylim([0,120]); ax2.set_ylabel('Probability')

est_mat = np.linspace(0,25,30) # calculate expected loss for all possible estimates

exp_loss = np.zeros(len(est_mat))

for iest, est in enumerate(est_mat):

error = -1*(bin_centroids - est)

loss_plot_est_curve = loss_function(error,m_under,max_under,m_over)

exp_loss[iest] = np.dot(loss_plot_est_curve,prob)

ax2b.scatter(est_mat,exp_loss,c='white',edgecolor='black',marker='o',s=40,zorder=10)

iopt_estimate = np.argmin(exp_loss); opt_est = est_mat[iopt_estimate]; opt_loss = exp_loss[iopt_estimate] # get optimum estimate and loss

ax1b.axvline(x=opt_est, color='red', clip_on=False,zorder=5) # add optimum estimate and loss to the first subplot

ax1b.annotate('Optimum Estimate',[opt_est-0.5,93.0],color='red',rotation = 90.0,zorder=5)

ax2b.scatter(opt_est,opt_loss,marker='s',s=100,color='red',edgecolor='black',zorder=10) # plot expected loss, estimate and optimum

ax2b.annotate('Optimum Estimate = ' + str(np.round(opt_est,2)),[opt_est,opt_loss+2],ha='center',color='red',zorder=10)

ax2b.plot([opt_est,opt_est],[0,opt_loss],color='red',lw=2,zorder=30)

ax2b.plot([opt_est,25],[opt_loss,opt_loss],color='red',lw=2,zorder=30)

ax2b.plot(est_mat,exp_loss,c='black',marker='o',lw=2,zorder=1)

ax2.set_xlim([0,25]); ax2.set_xlabel('Resources OIP (MMbbls)'); ax2.set_title('Expected Loss vs. Estimated Resources')

plt.subplots_adjust(left=0.0, bottom=0.0, right=2.0, top=1.0, wspace=0.2, hspace=0.2); plt.show()

To help you understand the nuts and bolts of the expected loss calculation for the estimate above, let’s make a table with,

truth values: bin centroids of the histogram

error: estimate - truth

loss: loss function applied to the error

probability: probability of truth being each outcome

probability times loss: for each possible for each outcome

df = pd.DataFrame([bin_centroids, error, loss_plot_est, prob*100,prob*loss_plot_est], index=['Truth', 'Error', 'Loss', 'Prob','Prob x Loss']).round(1)

df

| 0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | ... | 15 | 16 | 17 | 18 | 19 | 20 | 21 | 22 | 23 | 24 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Truth | 0.5 | 1.5 | 2.5 | 3.5 | 4.5 | 5.5 | 6.5 | 7.5 | 8.5 | 9.5 | ... | 15.5 | 16.5 | 17.5 | 18.5 | 19.5 | 20.5 | 21.5 | 22.5 | 23.5 | 24.5 |

| Error | 24.5 | 23.5 | 22.5 | 21.5 | 20.5 | 19.5 | 18.5 | 17.5 | 16.5 | 15.5 | ... | 9.5 | 8.5 | 7.5 | 6.5 | 5.5 | 4.5 | 3.5 | 2.5 | 1.5 | 0.5 |

| Loss | 130.0 | 120.0 | 110.0 | 100.0 | 90.0 | 80.0 | 70.0 | 60.0 | 50.0 | 40.0 | ... | 14.0 | 21.0 | 28.0 | 35.0 | 42.0 | 49.0 | 50.0 | 50.0 | 50.0 | 50.0 |

| Prob | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 1.5 | 13.2 | 17.4 | 13.6 | 12.2 | ... | 2.6 | 1.8 | 1.2 | 0.8 | 0.4 | 0.4 | 0.0 | 0.0 | 0.0 | 0.0 |

| Prob x Loss | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 1.2 | 9.2 | 10.4 | 6.8 | 4.9 | ... | 0.4 | 0.4 | 0.3 | 0.3 | 0.2 | 0.2 | 0.0 | 0.0 | 0.0 | 0.0 |

5 rows × 25 columns

Now to calculate the expected loss for our estimate, we sum the ‘Prob x Loss’ row.

expected_loss_demo = df.loc['Prob x Loss'].sum()

print(np.round(expected_loss_demo))

40.0

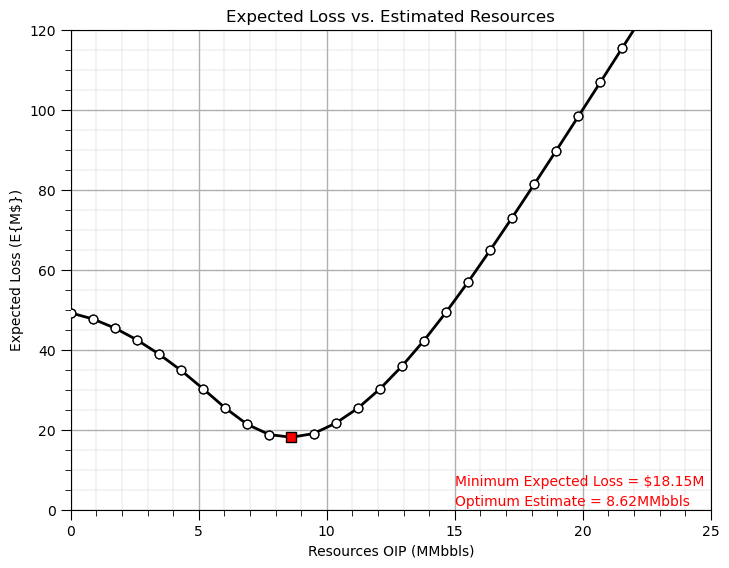

Minimizing the Expected Loss#

Let’s repeat the calculation of expected loss vs. estimate and then select the estimate that minimizes the expected loss.

the plot above included additional information for illustration, including the loss function positioned to calculate the expected loss of a specific estimate, so we remove that now

plt.subplot(111)

expected_loss = np.dot(loss_plot_est,prob)

plt.ylabel('Expected Loss (E{M$})'); plt.ylim([0,120]); ax2.set_ylabel('Probability')

est_mat = np.linspace(0,25,30)

exp_loss = np.zeros(len(est_mat))

for iest, est in enumerate(est_mat):

error = -1*(bin_centroids - est)

loss_plot_est = loss_function(error,m_under,max_under,m_over)

exp_loss[iest] = np.dot(loss_plot_est,prob)

min_est = est_mat[np.argmin(exp_loss)]

min_est_loss = exp_loss[np.argmin(exp_loss)]

plt.annotate('Minimum Expected Loss = $' + str(np.round(min_est_loss,2)) + 'M',[15,6],ha='left',color='red',zorder=20)

plt.annotate('Optimum Estimate = ' + str(np.round(min_est,2)) + 'MMbbls',[15,1],ha='left',color='red',zorder=20)

plt.scatter(min_est,min_est_loss,marker='s',color='red',edgecolor='black',s=50,zorder=40)

plt.scatter(est_mat,exp_loss,c='white',edgecolor='black',marker='o',s=40,zorder=10)

plt.plot(est_mat,exp_loss,c='black',marker='o',lw=2,zorder=1)

plt.xlim([0,25]); plt.xlabel('Resources OIP (MMbbls)'); plt.title('Expected Loss vs. Estimated Resources'); add_grid2()

plt.subplots_adjust(left=0.0, bottom=0.0, right=1.0, top=1.0, wspace=0.2, hspace=0.2); plt.show()

Want to Work Together?#

I hope this content is helpful to those that want to learn more about subsurface modeling, data analytics and machine learning. Students and working professionals are welcome to participate.

Want to invite me to visit your company for training, mentoring, project review, workflow design and / or consulting? I’d be happy to drop by and work with you!

Interested in partnering, supporting my graduate student research or my Subsurface Data Analytics and Machine Learning consortium (co-PI is Professor John Foster)? My research combines data analytics, stochastic modeling and machine learning theory with practice to develop novel methods and workflows to add value. We are solving challenging subsurface problems!

I can be reached at mpyrcz@austin.utexas.edu.

I’m always happy to discuss,

Michael

Michael Pyrcz, Ph.D., P.Eng. Professor, Cockrell School of Engineering and The Jackson School of Geosciences, The University of Texas at Austin

More Resources Available at: Twitter | GitHub | Website | GoogleScholar | Geostatistics Book | YouTube | Applied Geostats in Python e-book | Applied Machine Learning in Python e-book | LinkedIn

Comments#

This was a basic demonstration of optimum decision making in the precense of uncertainty.

we build uncertainty models all the time to support decision making. With theses codes and workflows you can make optimum decisions with your uncertainty model!

I have other demonstrations on the basics of working with DataFrames, ndarrays, univariate statistics, plotting data, declustering, data transformations, trend modeling, multivariate analysis and many other workflows available at GeostatsGuy/PythonNumericalDemos and GeostatsGuy/GeostatsPy.

I hope this is helpful,

Michael